GTP is the semi-permissioned protocol for remittance in 50+ countries and 23+ currencies for cross-border transfers, payouts, onramps, and offramps. Instead of slow and expensive correspondent banking where funds bounce between a number of intermediary banks and can experience multiple FX conversions, GTP uses stablecoins to directly settle between local PFIs licensed in that region.

Transfers need to arrive on time, every time. With multiple participating financial institutions (PFIs) covering certain jurisdictions, global transfer protocol (GTP) creates redundancy to ensure transactions are completed even in the event of a technical, regulatory, or other outage with a particular PFI versus only working with a single bank directly.

Higher volume creates lower costs costs. Global transfer protocol (GTP) combines the volumes of all network participants to participating financial institutions (PFIs) resulting in lower costs for all transactions through collective bargaining.

Coming next year, a smart order router (SOR) will sit on top of the network allowing PFIs to bid for transactions further reducing costs further by creating competition for transaction flow.

Global transfer protocol (GTP) orchestrates the compliance onboarding process across the right participating financial institutions (PFIs) across the network to complete the transaction.

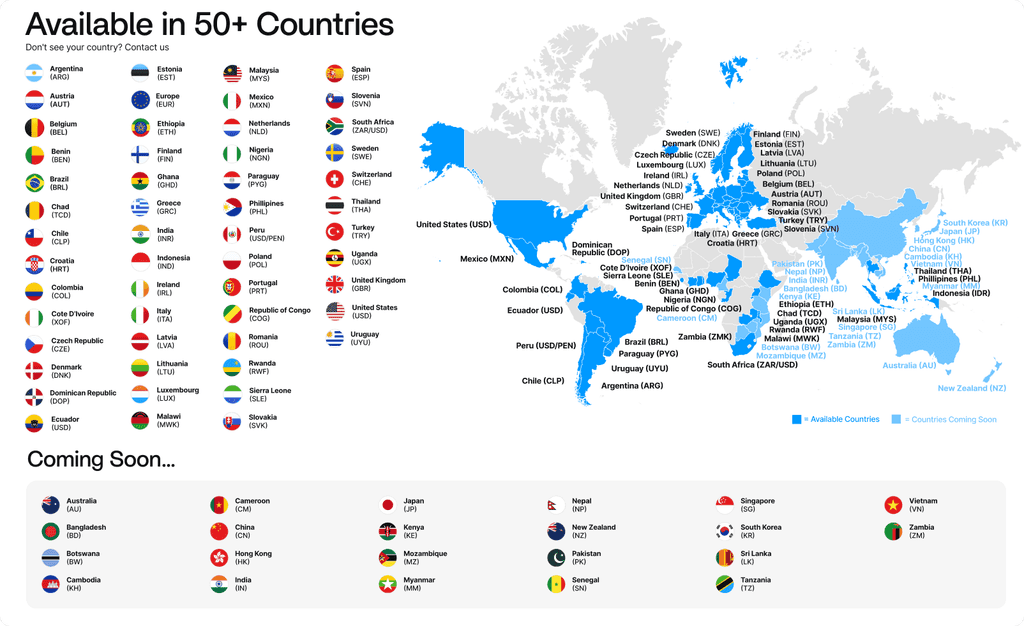

Geographic Coverage

Integrate the APIs to create a fully customized user experience and to seamlessly integrate the global transfer protocol (GTP) into your existing APIs, apps, and dashboards. The API is the most robust and powerful integration.

GTP maintains a straight forward REST API spanning transactions, compliance, crypto swaps/liquidity, and the participating financial institution (PFI) network.

Comprehensive guides, API references, and optional shared Slack channel with the Borderless engineering and ops teams simplifies integrations to launch quickly.

Integrations typically range from a few days to a couple weeks depending on the exact use-case, geographical coverage, and app complexity.